Coal gas water gas producer gas and similar gases other than petroleum gases and. Subscribe to RSS Feed.

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Renting of truck goods carriage with fuel.

. 7D Fuel tax credit. Both are exempt from the current sales tax. Fuel eg petrol diesel and fuel blends You can generally claim a credit for GST included in the price of fuel you purchase for use in your business.

Is it GST or N-T. Find GST HSN Codes with Tax Rates. It means that you will have to shell out GST at the rate of 18 on your bike insurance premium.

You can search GST tax rate for all products in this search box. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Here you can search HS Code of all products we have curated list of available HS code with GST website. At present if petrol comes under the law of GST the most used rates of 12 18 or 28 would be applicable. 0 Kudos 3 REPLIES 3.

I just like to know myob tax code for Fuel Tax Credit. In Following is list of products place in this slab. 1B GST on purchases.

0 Kudos 2 REPLIES 2. LIQUEFIED PETROLEUM GASLPGCYLINDER Products Include. All around the world same HS codes are used to discribe a product.

You have to only type name or few words or products and our server will search details for you. Explanation-For the purposes of this entry the specification of the motor vehicle shall be determined as per the Motor Vehicles Act 1988 59 of 1988 and the rules made. GST rates for all HS codes.

You may also be eligible to claim fuel tax credits. 12 rate of GST. HS Code Description GST 120190.

Under GST the petrol and diesel prices under the present circumstances will become substantially cheaper. Export and Import HSN Code. 5 12 18 and 28.

Coal gas water gas producer gas and similar gases other than petroleum gases and other gaseous hydrocarbons HSN code 2705. It was previously reported that the government was considering the possibility of exempting RON 95 petrol and diesel from GST. The Centre applied a total of INR 2790 per litre of excise duty on the petrol while INR 2180 per litre on the diesel fuel.

You can use 4 digit HS code to generate your invoices. The procedure to find HS Code with tax rate is very simple. Find GST HSN Codes with Tax Rates.

Here you can search HS Code of all products we have curated list of available HS code with GST website. HS Code is internationally accepted format of coding to describe a product. You are adviced to double check rates with GST rate book.

GST Tax Slab Rates List 2021. The GST regime provides five different taxation rates of 0 5 12 18 and 28 per cent. The GST rate on bike insurance is 18.

Taxes to be subsumed under GST are Excise Duty Service Tax Central Sales Tax Surcharge Fees VAT Taxes on Lottery Luxury Tax Entry Tax Entertainment Tax These are the parts of Central Tax State Tax. For more information see Fuel tax credits business. All goods not specified elsewhere.

There is an increase in the rate under the GST regime for two-wheeler insurance. In case the fuel prices are brought down and if the fuel prices come under the ambit of GST the loss on revenue combined would be 04 of the GDP. You can search GST tax rate for all products in this search box.

Analysis of GST on petrol Diesel Nowadays petrol. What is HS Code. Ronatbas Ultimate Partner 4553 Posts.

MV expenses - petrol which tax code should I use. OLD Tax Rate. What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 92.

Is GST claimablereportable on BAS. HSN code 2707 Oils and other products of refining of high temperature coal tar. Whether you go for comprehensive or third party insurance coverage this.

Under the earlier tax regime this rate was around 15. All HS Codes or HSN Codes for petrol with GST Rates. Petrol Liquefied petroleum gases LPG or compressed natural gas CNG driven motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm.

However to introduce petrol and diesel within the GST is a political call to action and it must be according to the decisions taken by both the centre and states. 18 rate of GST. 1B GST on purchases.

In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. Should amount claimed in BAS be excluding or including gst for tax purposes. The tax rates for various goods in related sectors are as follows.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. There is however a problem. You have to only type name or few.

Central State government are taking Excise Vat Tax respectively on petrol Diesel. What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 92. Tax rates are sourced from GST website and are updated from time to time.

Analysis of GST on petrol Diesel Nowadays petrol. GST rates for all HS codes. Additionally states also levy Value Added Tax VAT.

The current tax regime allows the Government as. The procedure to find HS Code with tax rate is very simple. Zero rated no GST.

Our business is registered for gst. Central State government are taking Excise Vat Tax respectively on petrol Diesel. Gi Metal Water Storage Tank.

The present notified rates are 0 5 12 18 and 28. Petrol and diesel cant be expected to be taxed belowmore than 28 per cent in the current scenario as it is major revenue part of Government.

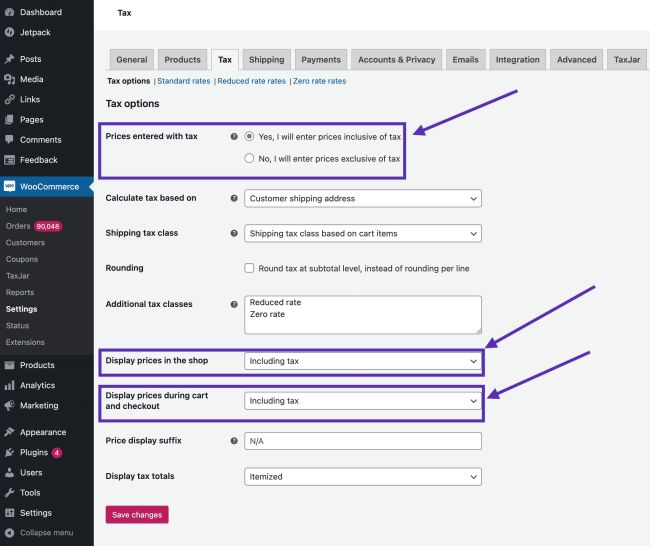

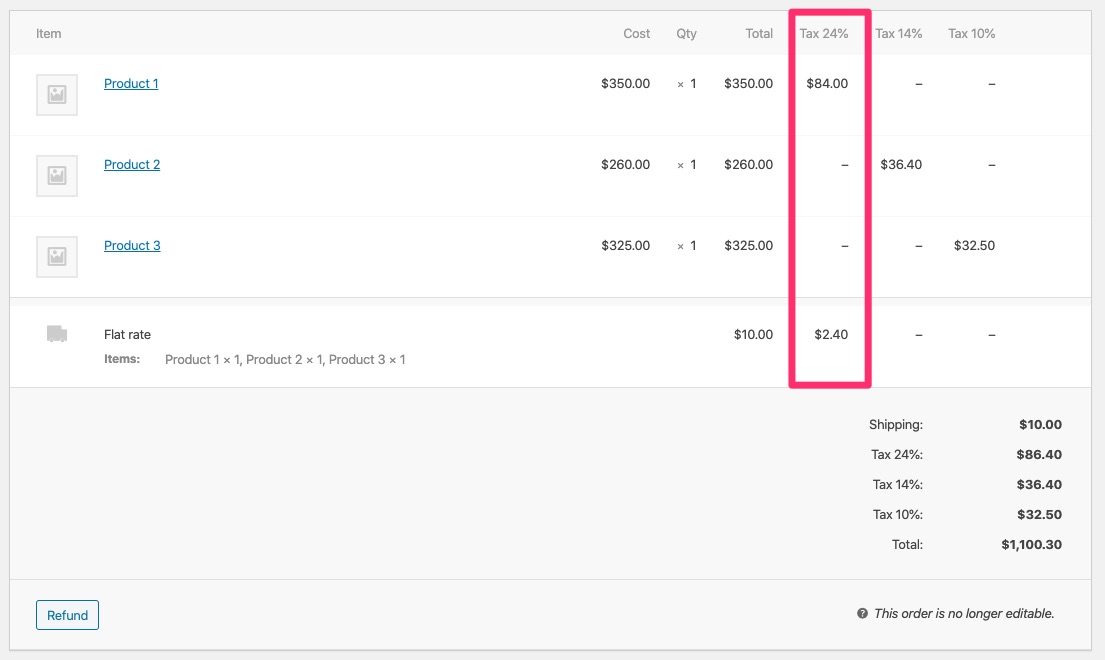

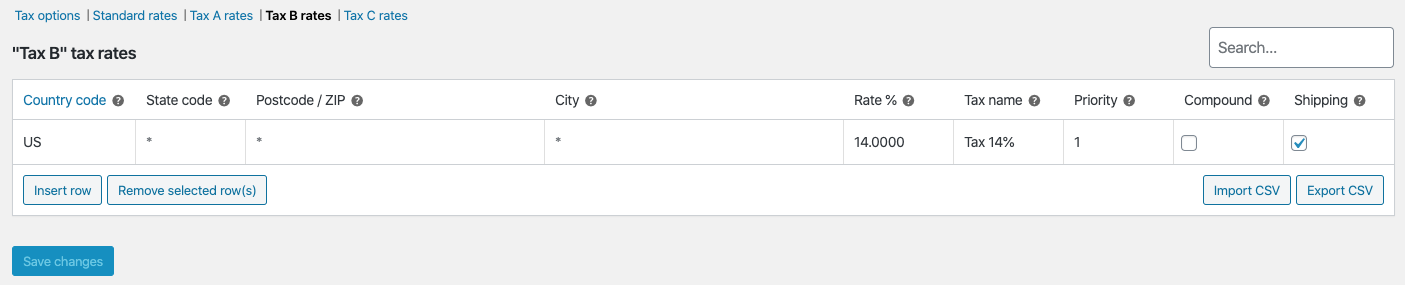

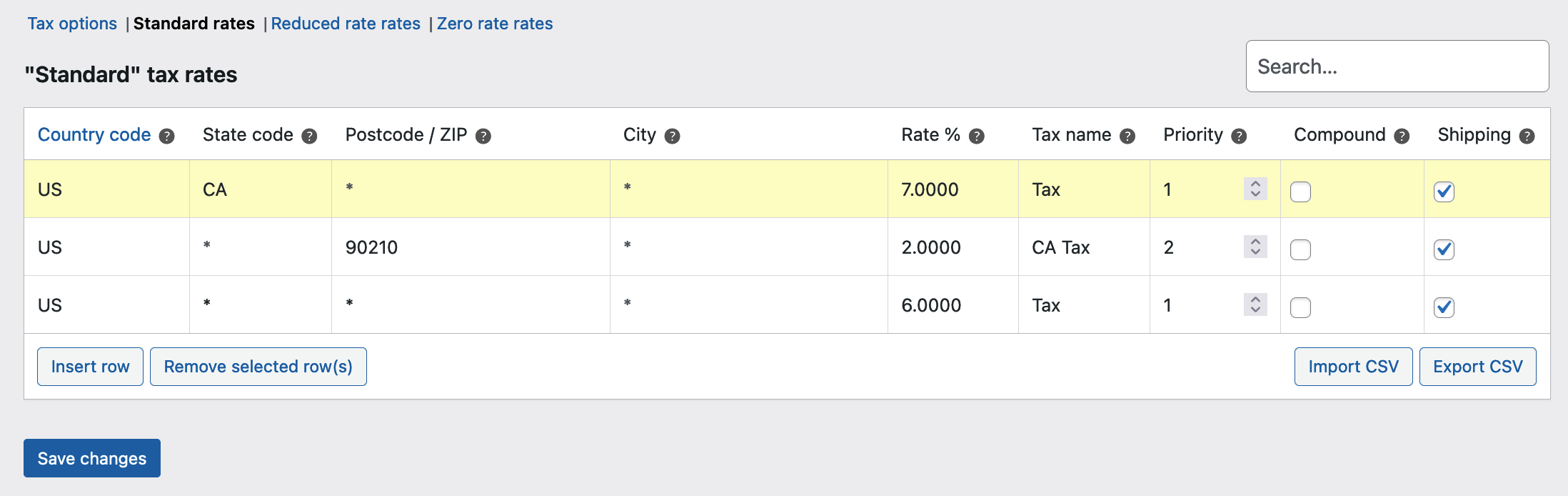

Setting Up Taxes In Woocommerce Woocommerce

The Use Of Tax Codes When Entering Transactions Exalt

Setting Up Taxes In Woocommerce Woocommerce

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Nearly Two Third Of The Price You Pay For Petrol Goes To Centre And States Diu News

Setting Up Taxes In Woocommerce Woocommerce

Setting Up Taxes In Woocommerce Woocommerce

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Gst At 5 Years India S Historic Tax Reform Is Out Of Fuel Mint

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

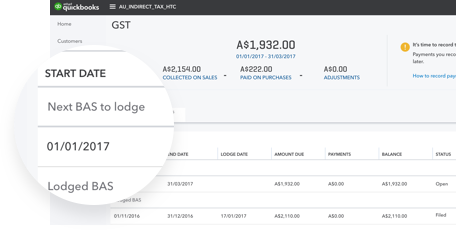

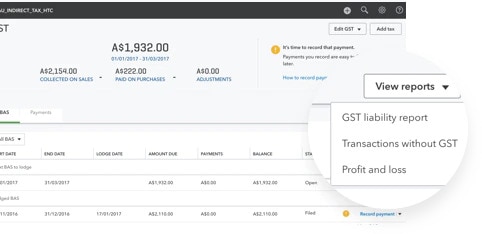

Setting Up Gst In Quickbooks Online Quickbooks Australia

Setting Up Gst In Quickbooks Online Quickbooks Australia

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Wep Bp Pro Handheld Thermal Billing Printer

Setting Up Taxes In Woocommerce Woocommerce

Nearly Two Third Of The Price You Pay For Petrol Goes To Centre And States Diu News